Source: Thredd

People need to pay for things, and people need to get paid. It’s the payments industry that makes it happen. Simply, seamlessly, and instantaneously.

The payments ecosystem is founded on confidence and trust, with every part working together to keep the world’s transactions running smoothly. And it’s Thredd’s invisible payments magic that connects all these constantly moving parts.

The industry’s growing at an astounding rate: according to a study by McKinsey [1], it made over $2.1 trillion globally in 2021, and will top $3 trillion by 2026. Meaning that there are almost limitless opportunities to make a big splash in the payments pool.

It’s an exciting network to be a part of, but with so many elements involved it can get quite complex. Here, we introduce you to some of the most important players, and explain their role in the wider payments ecosystem.

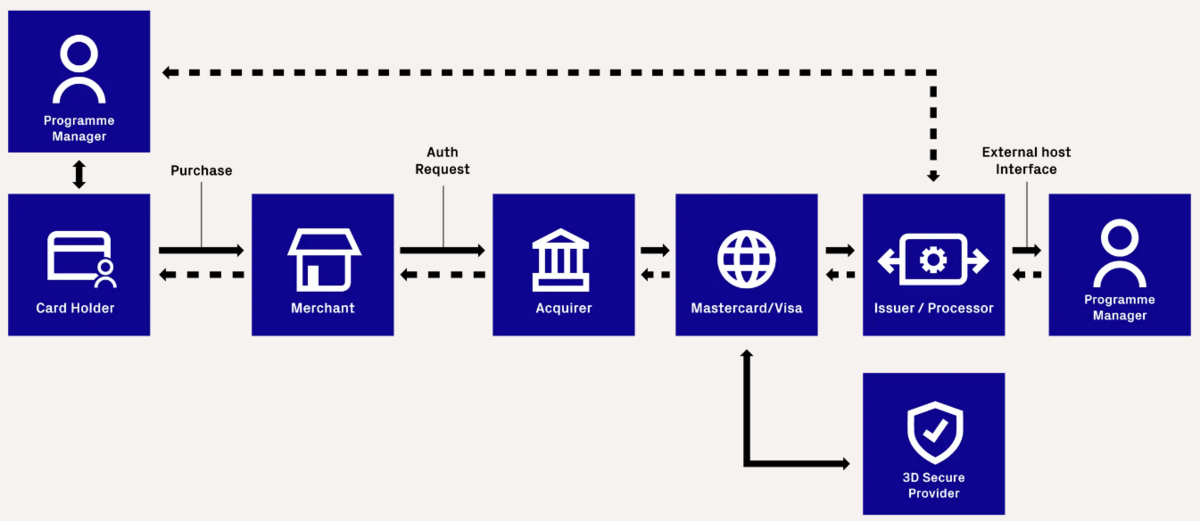

The payments process

The tap of a debit card only takes a second, but there are multiple cogs whirring behind the scenes before your payment can be completed and approved. The transaction and authorisation process form the heart of the payments industry, and the very fabric of Thredd.

- The cardholder is the customer or end user who wants to buy something

- The merchant (a retailer, online shop, government agency, etc, where the card is used) wants to sell something. And get paid for it.

- A card scheme, such as Visa or Mastercard, is the payment network used by all parties during a transaction. It links merchant acquirers to payment card issuers (like Thredd), managing relationships and laying down the rules for issuers to follow.

- A financial institution can become a principal member of a scheme if it meets certain requirements, and can then issue cards on that scheme’s network. So, if you see a Visa or Mastercard logo on another business’s card, you can assume they’re a principal member of that scheme.

- The merchant acquirer (or merchant services provider) is a bank or financial institution that accepts card transactions on behalf of the merchant. They provide the physical or electronic link to the scheme, and are also commonly the card issuer.

- The card issuer is the BIN (Bank Identification Number) sponsor, issuing BIN ranges to its customers to create new cards. Card issuers ‘own’ the cards they provide and are likely to be a principal member of multiple schemes, while also having direct relationships with issuer processors like Thredd.

- The issuer and/or processor (that’s us) has existing partner relationships and connections with schemes and card manufacturers. It’s integrated with service providers such as 3-D Secure, agency banking, multi-currency foreign Exchange (FX) and mobile wallet token providers. It also checks the status of the card and any rules around its usage before approving or declining a transaction.

- The programme manager needs a BIN from an issuer to be able to issue cards, alongside approval from the issuer to make any changes to its programme. They also maintain relationships with multiple partners, onboards and manages its customers, and carries out settlements of funds.

- The card programme manager often participates in the authentication decision alongside the issuer and/or processor.

- The 3-D Secure provider makes payments safer for customers. 3-D Secure is a protocol supported by the major card schemes, which provides cardholder authentication during an online transaction to help reduce the risk of fraud.

All these entities communicate with each other in a fraction of a second, so you can pay for your coffee or commute without it ever interrupting your day.

The payments ecosystem may look confusing, but we at Thredd are here to help. Our tight-knit partnerships within the network mean we can make the process seamless, and simplify even the knottiest payment problems. Get in touch today to find your fit in the global payments ecosystem.

[1] The chessboard rearranged: rethinking the next moves in global payments